Telekom Deutsche Insider Sells Shares of T-Mobile US Inc: What You Need to Know

Telekom Deutsche, a Director and 10% Owner of T-Mobile US Inc (NASDAQ:TMUS), recently made a significant move by selling 417,274 shares of the company on May 30, 2024. This insider transaction has caught the attention of investors and analysts alike, raising questions about the implications for the future of T-Mobile US Inc.

What Does This Insider Selling Indicate?

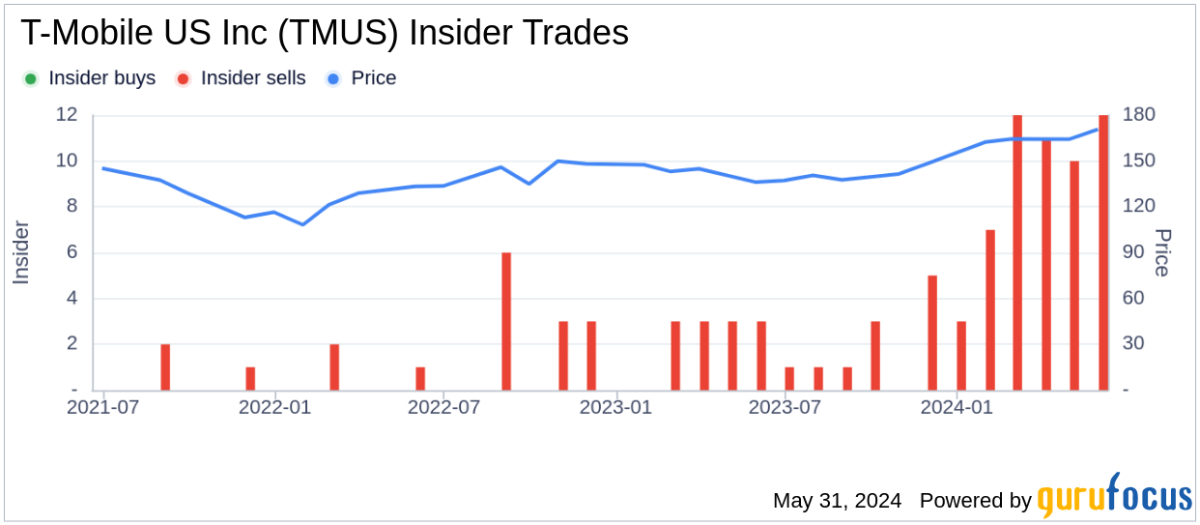

This latest insider sell by Telekom Deutsche comes amidst a series of similar transactions over the past year, totaling 19,160,903 shares. With no insider buys recorded during this period, it raises concerns about the insider sentiment towards T-Mobile US Inc. Investors are now wondering about the potential impact of these insider activities on the company’s stock performance and overall market value.

Market Valuation and Analyst Projections

Following the recent insider sell, T-Mobile US Inc shares were trading at $169.29, with a market cap of $200.036 billion. The stock’s price-earnings ratio of 23.22 suggests that it is trading above the industry median, raising questions about its current valuation. Analysts have calculated a GF Value of $146.45 for T-Mobile US Inc, indicating a modest overvaluation based on various valuation metrics. This discrepancy has sparked discussions among investors about the true worth of the company and its growth potential in the coming years.

In conclusion, the insider selling activity by Telekom Deutsche has prompted a closer examination of T-Mobile US Inc’s financial health and market position. Analysts and investors are closely monitoring the developments to gauge the impact on the company’s stock performance and long-term prospects.