According to an analysis, German car manufacturers suffered a setback at the beginning of the year compared to other countries. “With a drop in sales of 1.7 percent and a drop in profits of a quarter, the three German car companies performed significantly worse overall than the majority of their competitors,” the auditing and consulting firm EY announced on Wednesday.

Together, Volkswagen, BMW and Mercedes-Benz generated sales of around 148 billion euros. This was still the second highest figure in a first quarter since the study was conducted. For the analysis, EY evaluated the financial figures of the world’s 16 largest car manufacturers. The survey has been conducted since 2011.

Compared to the same period last year, sales for all companies rose by 3.9 percent to around 493 billion euros in the first quarter. Earnings before interest and taxes (EBIT) were around 33.8 billion euros – 0.7 percent higher than a year earlier.

With a profit increase of around 87 percent and a sales growth of 17 percent, the car manufacturers from Japan in particular performed well: This was due to the ongoing decline in the value of the yen, which makes Japanese products cheaper abroad and leads to exchange rate gains.

Profitability fell slightly: the average EBIT margin, which compares operating profit to sales, was 7.4 percent. The most profitable car company was Kia, with 13.1 percent.

The South Koreans lead the rankings ahead of BMW (11.1 percent) and Mercedes (10.8 percent). The latter was the most profitable company in 2023 as a whole, ahead of Stellantis. Opel’s parent company did not provide any information on profits in the first year. The margin of the electric car manufacturer Tesla fell from 11.4 to 5.5 percent compared to the previous year.

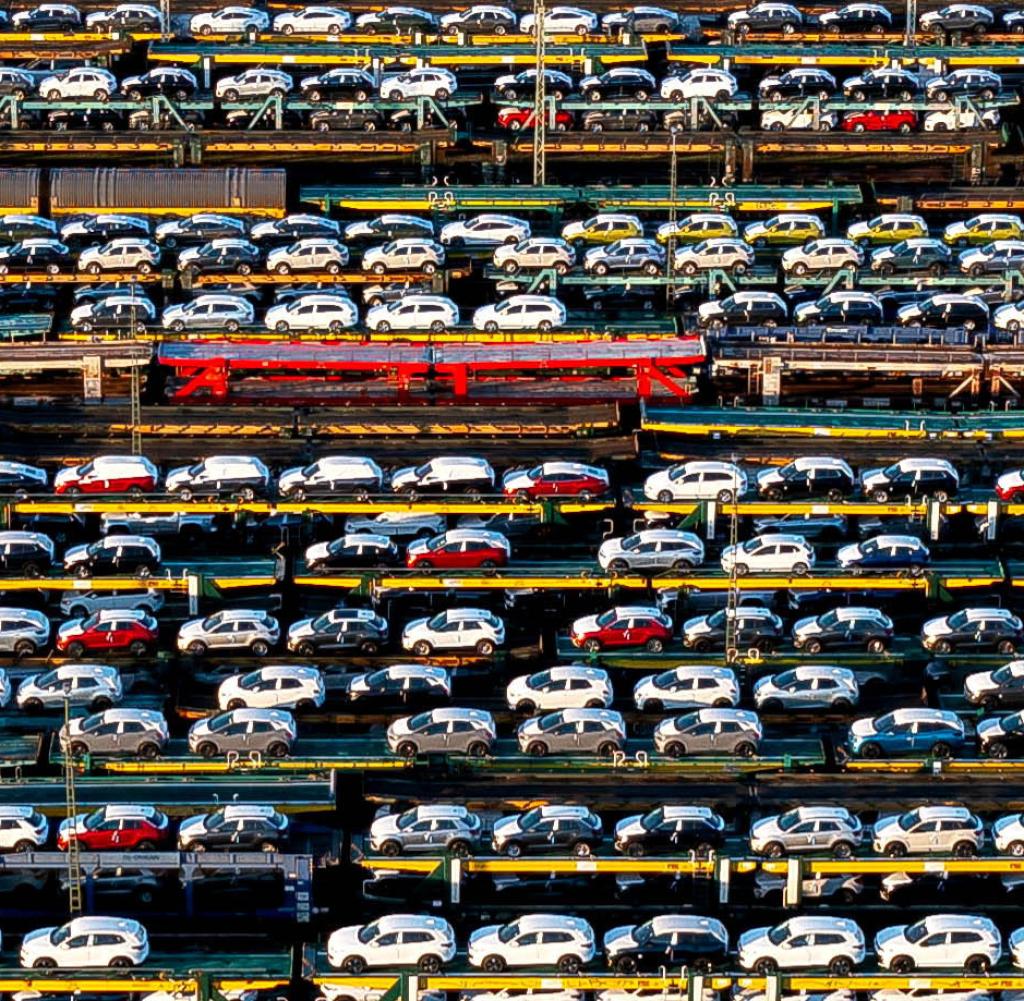

According to EY market observer Constantin Gall, the headwind for the auto industry is increasing. “In the first quarter, new car sales by the top automakers fell slightly, and demand is nowhere near pre-pandemic levels,” he said. From January to March, manufacturers sold around 15.5 million cars, around three million fewer than in the first quarter of 2019.

According to Gall, a quick recovery is currently not foreseeable: the economy is weakening, and geopolitical tensions and wars are causing great uncertainty in many regions. “The unclear development of e-mobility is also slowing things down: sales of electric cars are disappointing in both Europe and the USA,” he said. The question of which technologies will prevail again appears relatively open, so the industry will have to invest in several types of drive in parallel.

In addition, the Chinese car market is developing with difficulty, at least for Western manufacturers. “Domestic suppliers are gaining market share, especially in the electric segment. The cut-throat competition is brutal,” said Gall.

While the car companies increased their car sales in Europe by three percent and in the USA by almost six percent, they recorded a decrease of two percent in China. At least: The German manufacturers recorded a slight increase in China. In the first quarter, 33.2 percent of their global new car sales came from the country.