Business scams are becoming increasingly common as criminals seek to maximize their profits with minimal effort. Homeowners have now become a new target for these scammers, especially with much of the home-buying process now taking place online, involving the transfer of large sums of money. Both buyers and sellers are at risk of falling victim to these fraudulent activities.

Recently, a woman from Minnesota received a disturbing phone call regarding her husband’s alleged unpaid loan from years ago, leading to a threat of a lien being placed on their home. The caller provided her with a case number and a phone number to call for further details. Despite her husband’s denial of ever taking out a loan, the woman decided to verify the information by contacting the county recorder, who confirmed that there was no record of any outstanding loan against their property. This incident serves as a cautionary tale for homeowners nationwide who may be targeted by scammers.

Homeowners are particularly vulnerable to scams that involve false claims of owing money, with scammers using tactics to intimidate victims into immediate payment to avoid losing their property. While lenders may establish liens to secure loans and claim property if payments are not made, there is always a paper trail that can be traced for verification.

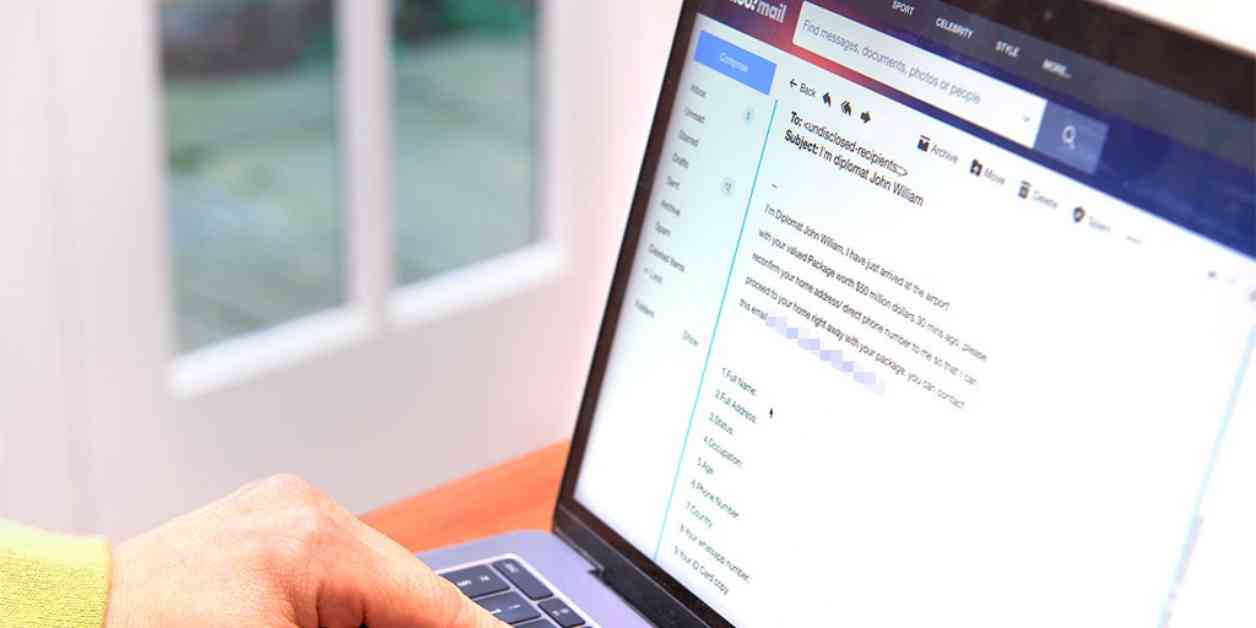

Individuals facing foreclosure are also targeted by scammers who offer false promises of assistance in exchange for cash payments. Additionally, prospective homebuyers are not exempt from these fraudulent activities, as scammers create fake real estate listings and deceive buyers into making deposits or wire transfers under false pretenses.

In a recent case in New Jersey, a couple lost $32,500 while purchasing their dream home due to scammers fabricating an entire email thread involving their lawyer, the seller’s lawyer, and the real estate agent. The couple unknowingly wired their down payment savings to the scammers, who had created email addresses similar to the legitimate ones, highlighting the importance of verifying email addresses to prevent falling victim to such scams.

To protect oneself from property fraud, it is recommended to sign up for free notification alerts offered by some counties, which inform individuals via email, voicemail, or text when a land document like a deed is recorded in their name. While not all counties may provide this service, individuals can check online resources, contact the county recorder directly, or search for property fraud alerts on their county’s official website to stay informed and vigilant against potential scams.

In conclusion, homeowners, buyers, and sellers should remain cautious and proactive in safeguarding their assets and transactions from fraudulent activities. By staying informed, verifying information, and utilizing available resources for protection, individuals can reduce the risk of falling prey to scams in the real estate market. Share this information with friends and family to raise awareness and prevent others from becoming victims of property-related fraud.