Real Estate Investment Fund Imposes Restrictions Amid Cash Crunch Concerns

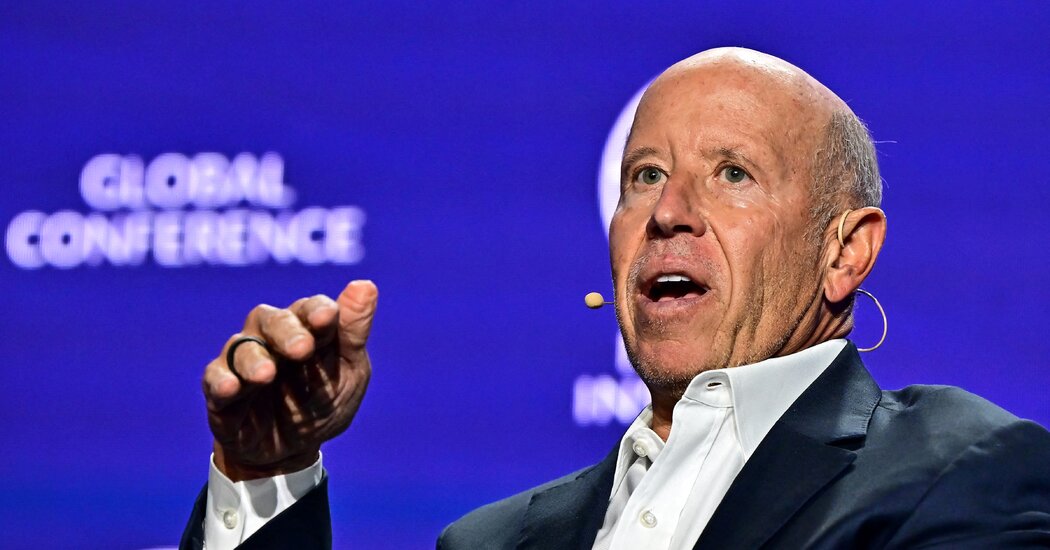

In a move to prevent a potential cash shortage due to the impact of high interest rates on the commercial real estate market, Starwood Real Estate Income Trust, managed by Barry Sternlicht’s Starwood Capital Group, has implemented restrictions on investor withdrawals. The fund, which manages approximately $10 billion in assets, announced that it will now only redeem 1 percent of the value of its assets per quarter, down from the previous 5 percent.

The decision to limit withdrawals comes as the fund faces a higher volume of redemption requests than it can currently accommodate with available cash reserves. Rather than selling properties at discounted prices to raise funds, Starwood has opted to impose withdrawal limits to maintain stability in a challenging market environment. The decline in property values, exacerbated by reduced occupancy rates amid the ongoing pandemic and elevated interest rates, has contributed to the fund’s cautious approach.

While this strategy aims to safeguard the fund’s financial position, it may deter potential investors and impact fundraising efforts in the future. Industry experts anticipate that the restrictions could lead to a decrease in investor confidence and slow down capital inflows into the real estate investment trust sector. The decision underscores the complex dynamics at play in the real estate market, where balancing liquidity needs with long-term investment strategies is crucial for sustainable growth.

As the real estate sector navigates through economic uncertainties and market volatility, investors are closely monitoring the fund’s performance and strategic decisions. The imposition of withdrawal limits serves as a reminder of the challenges facing the commercial real estate industry and the importance of prudent financial management in turbulent times.

Barry Sternlicht’s Real Estate Fund Adopts Protective Measures Amid Market Volatility

The recent announcement by Starwood Real Estate Income Trust, led by billionaire investor Barry Sternlicht, to restrict investor withdrawals reflects the fund’s proactive stance in response to prevailing market conditions. With the commercial real estate sector grappling with the effects of high interest rates and evolving economic landscapes, the decision to limit redemptions underscores the fund’s commitment to safeguarding investor interests and maintaining financial stability.

By curtailing the redemption rate to 1 percent of asset value per quarter, Starwood aims to address liquidity challenges and mitigate potential cash flow constraints in a challenging environment. The move, while aimed at ensuring operational resilience, may have wider implications on investor sentiment and fundraising activities within the real estate investment trust industry. As investors evaluate the fund’s performance and outlook, the decision to impose withdrawal restrictions highlights the importance of strategic risk management in uncertain times.

Impact of Withdrawal Limits on Real Estate Investment Trust Sector Amid Economic Uncertainties

Starwood Real Estate Income Trust’s decision to limit investor redemptions has reverberated across the real estate investment trust sector, prompting discussions on the implications for market dynamics and investor behavior. The fund’s strategic move to prioritize liquidity management over immediate asset sales reflects a nuanced approach to navigating market volatility and economic uncertainties.

As investors assess the implications of withdrawal restrictions on their investment strategies, industry experts emphasize the need for a balanced approach to risk management and portfolio diversification. The evolving landscape of the commercial real estate market underscores the importance of adaptability and foresight in decision-making, especially in times of economic flux. By closely monitoring market trends and investor sentiment, real estate investment trusts can position themselves for long-term growth and resilience amidst changing market conditions.