Nvidia’s Stock Soars Past $1,000 Mark: A Tenfold Rise Predicted by 2026

In a groundbreaking move, Nvidia’s stock has surpassed the $1,000 mark, reaching new heights and capturing the attention of investors worldwide. With a staggering 248% increase since the release of their earnings report, Nvidia’s future looks promising. The recent quarterly earnings report exceeded expectations and raised guidance, leading to a 10-for-1 stock split, significant stock buybacks, and a boost in dividends. As the company prepares for a post-split era with shares priced around $100, the potential for sustained growth remains high. Here are three key factors that could drive Nvidia’s shares back over $1,000 post-split.

Nvidia’s Continued Growth Trajectory and Strategic Investments

Nvidia’s exceptional performance in the first quarter of fiscal year 2025 showcased a 54% growth forecast surpassing expectations. With record-breaking revenue, gross margins, and earnings per share, the company’s growth trajectory remains strong. Strategic investments in data centers and innovative products like the H100 and Blackwell are driving revenue growth. Nvidia’s dominance in the AI chip industry, with a market share between 80% and 95%, is a testament to their market power and technological innovation. As the company continues to expand its customer base and product offerings, the future looks bright for Nvidia’s growth and profitability.

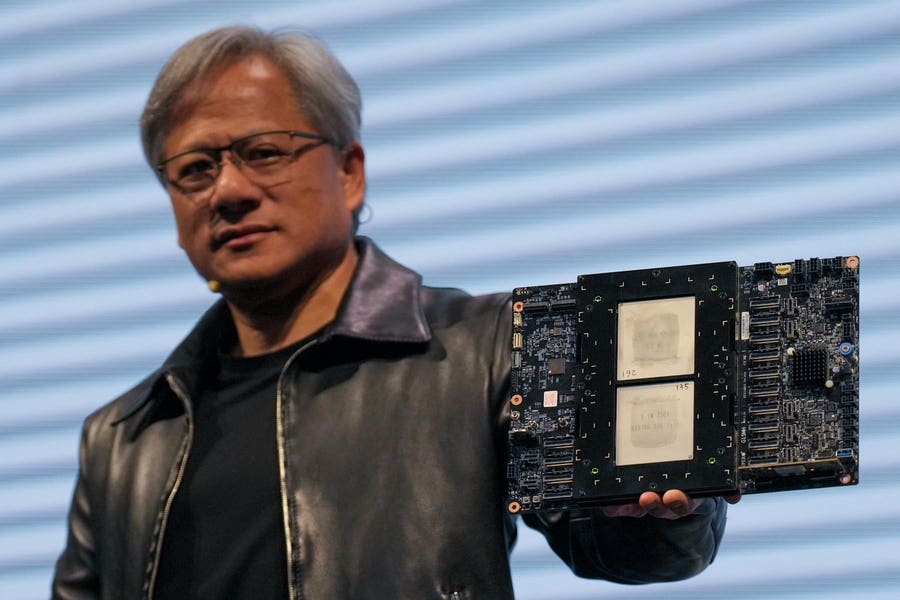

The Leadership Challenge: Ensuring Success Beyond Jensen Huang

While Nvidia’s success under CEO Jensen Huang has been remarkable, the company faces a significant leadership challenge in ensuring continuity and success beyond his tenure. Huang’s strategic vision, customer-centric approach, and ability to drive innovation have been key factors in Nvidia’s growth. However, the company must focus on developing a strong leadership pipeline and succession plan to sustain its momentum. As Nvidia prepares for a post-split era and aims for a tenfold rise by 2026, the role of leadership in driving growth and innovation cannot be understated. By investing in talent development and succession planning, Nvidia can secure its position as a market leader and continue its upward trajectory in the years to come.

In conclusion, Nvidia’s stock has reached new heights, crossing the $1,000 mark and setting the stage for further growth. With a strategic focus on innovation, growth investments, and leadership development, Nvidia is poised for success in the ever-evolving tech landscape. As the company navigates the challenges ahead and prepares for a post-split era, the road to a tenfold rise by 2026 is paved with opportunities for continued growth and profitability.