NY Fed Survey Reveals Changes in Consumer Inflation Expectations

The recent survey conducted by the NY Fed has shown some interesting trends in consumer inflation expectations. While the overall outlook remains stable, there have been some notable shifts in various key areas.

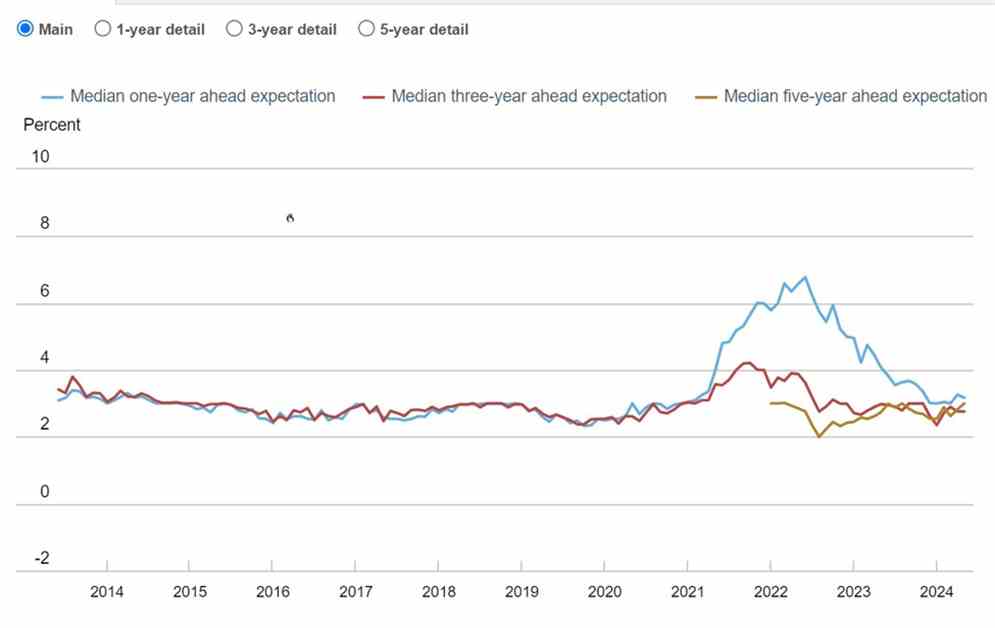

One of the main findings of the survey is that one-year inflation expectations have fallen slightly to 3.2% from 3.3%. However, three-year inflation expectations have remained unchanged at 2.8%, while five-year inflation expectations have actually risen to 3.0% from 2.8%.

In addition to these changes, the survey also highlighted other important details. Median home price growth expectations have stayed steady at 3.3%, while expectations for gas, food, and rent prices have remained relatively unchanged. On the other hand, medical care costs are expected to increase, while college costs are expected to decrease.

When it comes to the labor market, median expected earnings growth for one year has remained at 2.7%. However, there has been a slight increase in the mean unemployment expectations, which rose to 38.6% from 37.2%. The probability of job loss has decreased, while voluntary job leaving has increased.

In terms of household finance, expected household income growth has seen a slight uptick to 3.1%, while expected household spending growth has decreased to 5.0%. Perceptions of current credit access have not changed significantly, but future credit access is expected to tighten. The probability of missing a debt payment has decreased, and expectations for year-ahead tax changes have also decreased.

Overall, the survey paints a mixed picture of consumer expectations in various areas of the economy. While some indicators are showing stability, others are pointing towards potential changes in the near future. It will be important to monitor these trends closely to understand the potential implications for the economy as a whole.

Tags: USD, inflation, consumer expectations, NY Fed survey, economy, labor market, household finance, financial outlook.