The Ifo Institute has doubled its forecast for the growth of the German economy this year. Gross domestic product is expected to increase by 0.4 percent instead of the 0.2 percent expected in March, according to the economic forecast published by the Munich-based researchers on Thursday. An acceleration to 1.5 percent is still expected for the coming year.

“New hope is emerging,” said Ifo economic chief Timo Wollmershäuser. “The German economy is slowly working its way out of the crisis.” The second half of 2024 is likely to be significantly better than the first. At the same time, inflation will ease. While consumer prices rose by 5.9 percent last year, they are only expected to rise by 2.2 percent this year and 1.7 percent next year. “Over the course of the year, the purchasing power of private households is likely to continue to grow and the overall economic recovery will gain momentum as consumer spending normalizes,” said Wollmershäuser.

Global trade in goods and global industrial production are expected to continue to recover, particularly from the second half of the year. This should also be helped by a gradual revival of investments, supported by the easing of monetary policy in industrialized countries. The Ifo Institute expects the European Central Bank to cut interest rates two more times this year, after the ECB lowered its key interest rate for the first time since 2019 in June – from 4.50 to 4.25 percent.

The number of employed people is expected to rise from 45.9 to 46.1 million this year, and then reach 46.2 million in 2025. According to the forecast, the number of unemployed will initially increase from 2.6 to 2.7 million, before falling again to 2.6 million. The government deficit is expected to fall from 99 billion euros to 73 billion, before falling further next year to just 54 billion euros, according to the Ifo Institute.

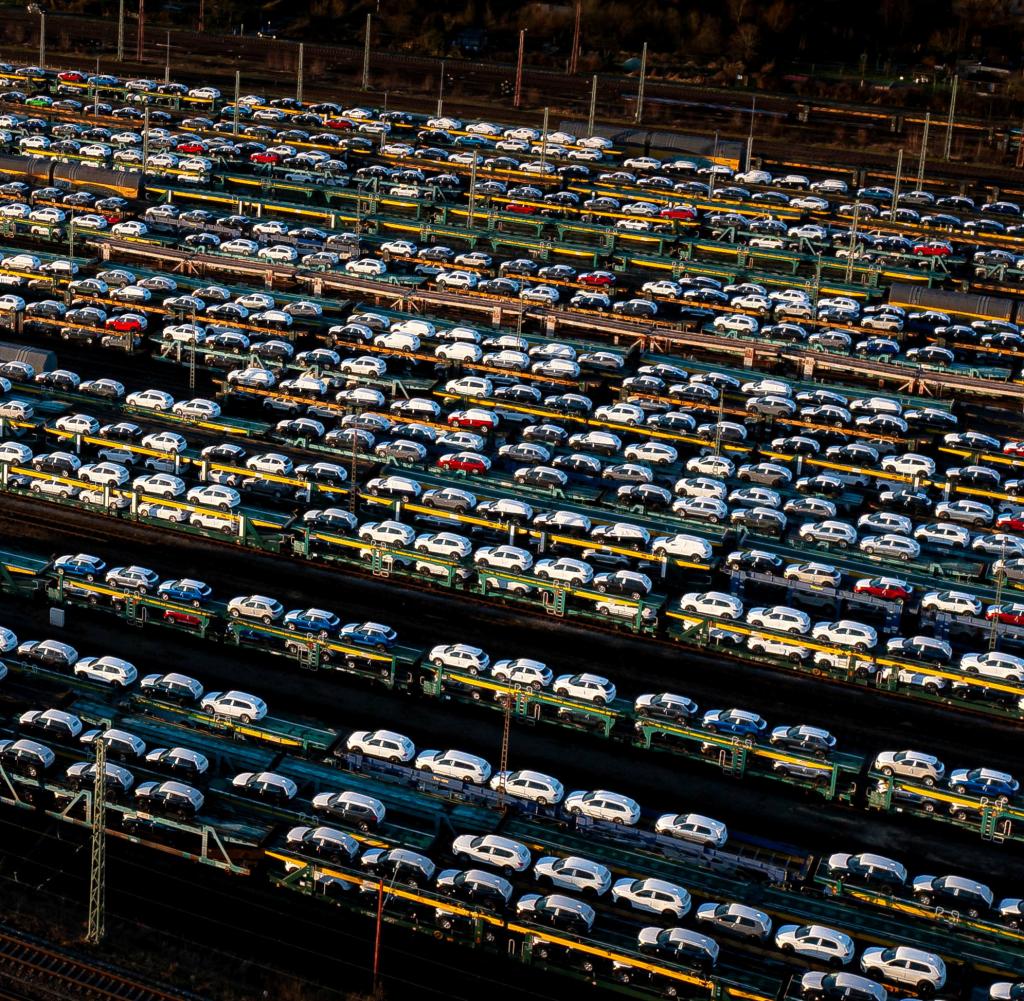

The internationally criticized current account surplus is expected to grow to 312 billion euros this year and then to 306 billion euros in 2025. That would initially be 7.3 and then 7.0 percent of economic output. The EU Commission has just criticized these surpluses. “Imbalances continue to exist in Germany,” it said. Weak domestic demand and a lack of investment are contributing to high current account surpluses. These are mainly fed by high export surpluses and are expected to continue to rise this year and next year.

“Given the size of the German economy and its trade links with the eurozone, this has a negative impact on the rest of the eurozone,” said Brussels. Countries with large surpluses are faced with others with enormous deficits, which have to take on debt to achieve this.