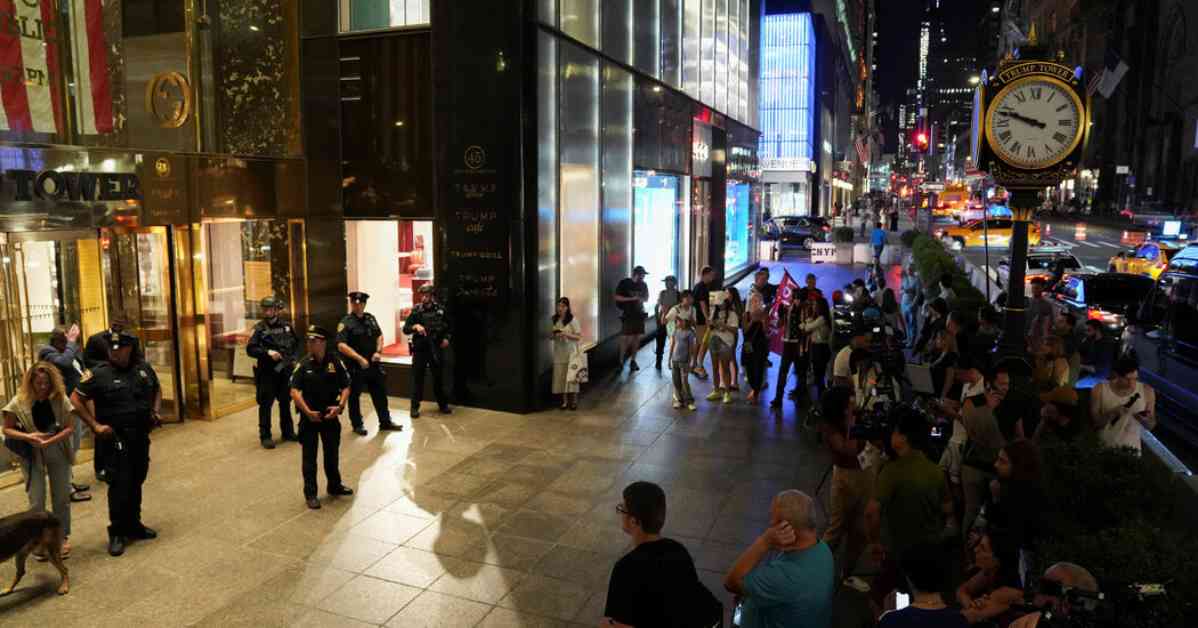

Supporters of former President Donald J. Trump gathered outside Trump Tower in Manhattan, seeking comfort and solidarity after a recent shooting incident. The crowd consisted of a mix of locals, tourists, and fans who were drawn to the iconic building on Fifth Avenue.

Christine Randall, 59, shared her emotional reaction to the rally and the subsequent shooting, expressing relief when she saw that Mr. Trump was unharmed. She quickly grabbed her pro-Trump gear and made her way to Trump Tower, joined by a group of about two dozen individuals who wanted to show their support.

Despite the late hour, the supporters engaged in conversations about their experiences during the rally and took photos together, proudly displaying their Trump-themed clothing and accessories. They received honks and gestures of support from passing drivers and pedestrians, creating a sense of camaraderie among like-minded individuals.

One attendee, Lynda Andrews, expressed her unwavering loyalty to Mr. Trump, noting that she was originally from Pennsylvania, where the rally took place. After witnessing the events of the evening unfold on television, she felt compelled to join the gathering outside Trump Tower, eager to stand by her chosen candidate.

As the night wore on, the group remained outside the building, determined to show their dedication to Mr. Trump. Their presence symbolized a strong sense of community and solidarity among his supporters, who found comfort in coming together during a tumultuous time. The gathering served as a testament to the enduring loyalty and passion of those who continue to stand by the former president.