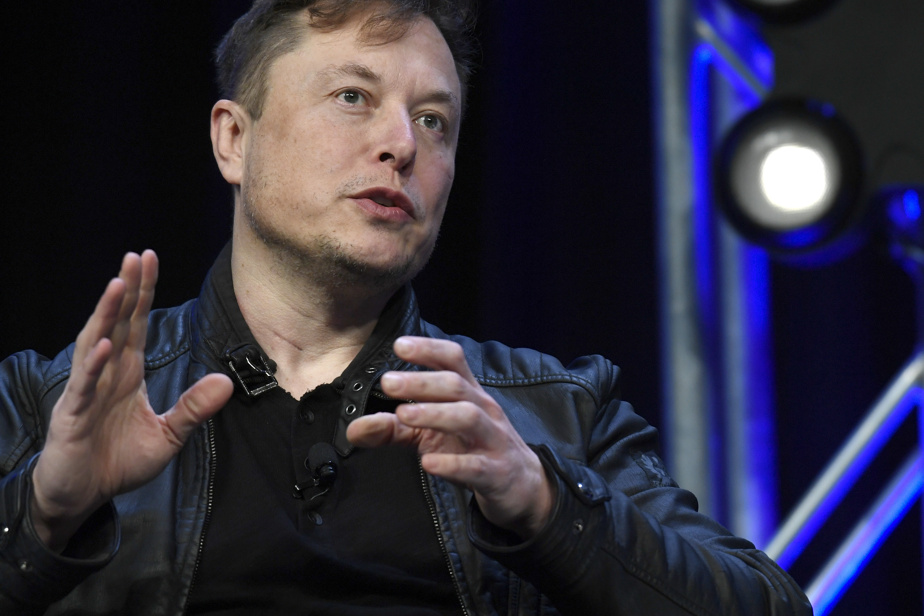

(New York) Tesla CEO Elon Musk said the group’s shareholders had approved his megapay “by a large majority”, in a message published on his social network X, before the conclusion of the vote.

“Both Tesla shareholder resolutions are now passed by a large majority!” Musk wrote late Wednesday night in the US, referring to resolutions to approve his $56 billion compensation plan and the transfer of Tesla’s registration from Delaware to Texas.

Official voting results have not yet been released.

The car manufacturer campaigned in all directions until the last moment for its shareholders to adopt its boss’s enormous remuneration plan.

“Time is running out,” the website votetesla.com created for the occasion posted Wednesday afternoon, while a countdown ticked off the seconds until 11:59 p.m. in Texas (12:49 a.m. Eastern time). ), poll closing time.

“Your vote is crucial to the future growth and success of Tesla and to the value of your investment,” insisted the electric vehicle specialist in a video explaining, with the help of his humanoid robot Optimus, how to vote.

To attract votes, the group put into play, by drawing lots, fifteen visits to the Austin mega-factory with Elon Musk and Franz von Holzhausen, Tesla’s chief designer, as guides.

In addition to the dedicated site and Optimus’ help, numerous messages have been published on X, as well as advertisements on the internet. Worthy of an electoral campaign.

The group is counting on small investors to make the difference against large investors, several of whom have announced in recent days that they are opposed to the remuneration package.

These institutional investors did the same on March 21, 2018, when this financial package was submitted to shareholders at an extraordinary general meeting. The “yes” vote won by 73%, excluding the votes of Elon Musk and his brother Kimbal.

The package was estimated at $56 billion and provided for stock distributions for ten years, based on specific objectives.

But a shareholder’s appeal to a Delaware court resulted in it being overturned by a judge in late January.

In mid-April, the board of directors undertook a maneuver to get it back on track by including it on the menu for Thursday’s ordinary general meeting.

“The board supports this compensation plan. We believed in it in 2018, asking Elon to pursue remarkable goals to grow the company,” the board argued at the time.

Tesla shares were worth $20.70 at Wall Street’s close the day before the 2018 AGM, and $177.29 at close on Wednesday.

According to the Wall Street Journal, the “yes” and “no” votes were neck and neck on Tuesday.

“We think investors are going to need to buckle up ahead of what is expected to be a volatile week for their stocks,” warned CFRA Research analyst Garrett Nelson.

According to him, individual shareholders hold around 40% of the manufacturer’s capital.

The fear, he underlined like other experts and shareholders favorable to the plan, is that, in the event of refusal by the AG, the billionaire will turn away from Tesla to devote himself more to his other companies (SpaceX, X, xAI, Starlink, etc.).

However, for many, Tesla is nothing without Elon Musk.

Tesla represents the largest asset in its portfolio (around $3 billion as of March 31) but it remains a leg up on Vanguard, the leading investor with a 7.23% share at the end of 2023.

Asked by AFP, the latter refused to reveal his vote and BlackRock, second investor with 5.9%, did not respond.

According to the Wall Street Journal, in 2018, the former voted against it, while the latter approved the plan.

The California Teachers’ Pension Fund (CalSTRS), one of the three largest in the United States, has decided: no.

“This compensation plan is ridiculous,” said Chris Ailman, its investment director, on CNBC, emphasizing that it amounted to paying Elon Musk “140 times the average employee’s salary.”

Same refusal from the Norwegian sovereign fund NBIM – the largest in the world and a shareholder of Tesla with 0.98% at the end of 2023 – as in 2018.