Tesla’s stock price has long been seen as a reflection of Elon Musk’s influence on the company. After a significant increase following a vote on Musk’s compensation package in 2018, investors have started to show signs of uncertainty.

The recent Tesla shareholder vote on Musk’s pay has become a measure of the company’s performance under his leadership. Despite Musk’s claims of victory on social media, indicating strong support for his compensation plan, Tesla’s stock has been struggling, suggesting that investors have reservations about the company’s future.

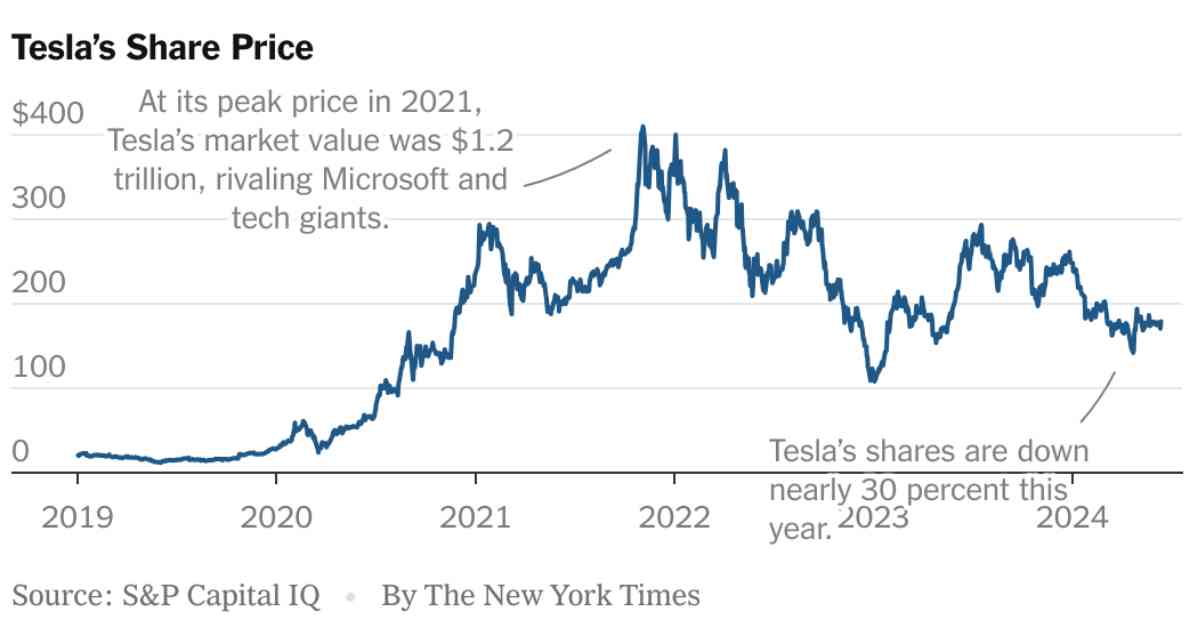

This year alone, Tesla’s shares have dropped by nearly 30%, contrasting with the overall stock market’s 14% increase. Once valued at $1.2 trillion, Tesla’s market cap has plummeted to around $576 billion, placing it in the same league as more traditional companies like Visa and Walmart.

The decline in Tesla’s stock price can be attributed to concerns about the company’s business prospects. With increased competition in the electric vehicle market, Tesla’s sales have been strong but show signs of tapering off. In an attempt to boost demand, the company has implemented price cuts, which have impacted profit margins. Furthermore, the absence of new models on the horizon has raised doubts about Tesla’s ability to sustain growth.

Analysts like Toni Sacconaghi from Bernstein note that Tesla has been facing challenges in expanding its business due to the lack of new product offerings. In the first quarter of this year, Tesla’s profits dropped by 55% year-over-year, while revenue decreased by 9% to $21.3 billion. The company also announced plans to lay off 10% of its workforce, affecting 14,000 employees.

As Tesla’s stock price continues to fluctuate and investors remain cautious, the future of the company under Elon Musk’s leadership remains uncertain. Despite Musk’s optimistic claims, the challenges faced by Tesla in terms of competition, demand, and product innovation highlight the need for a strategic shift to regain investor confidence and drive sustainable growth in the long run.