Wall Street’s Innovative Approach to Bad Governance in Sri Lanka Sparks Interest

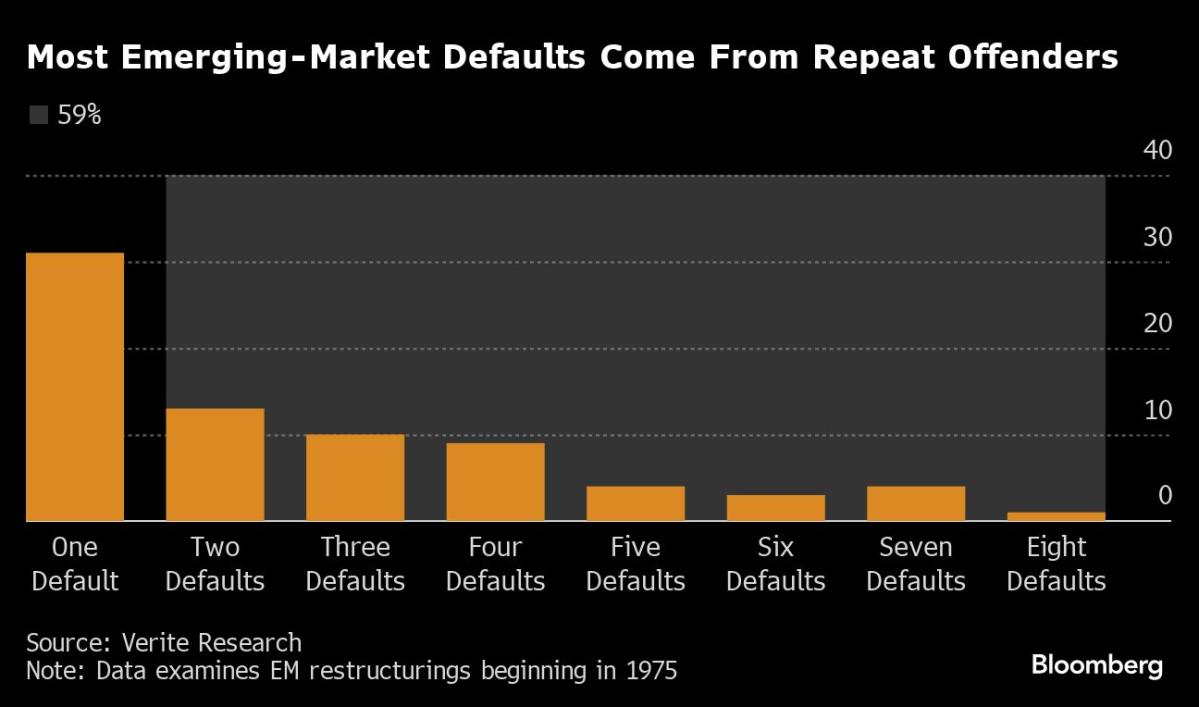

In a groundbreaking move, Wall Street is targeting bad governance in Sri Lanka through a unique bond deal that aims to incentivize the government to improve its tax collection and overall governance. Nishan de Mel, an Oxford-trained economist, has been at the forefront of this initiative, highlighting the correlation between poor governance and government defaults. His proposal, which offers incentives to bond investors for government improvements, has gained traction and is now a key element of Sri Lanka’s $12 billion debt restructuring deal.

Key Elements of the Governance-Linked Bond Deal

Under the governance-linked bond, Sri Lanka’s interest rates could be reduced by up to .50 percentage points if the government meets certain targets related to tax collection and transparency. This innovative approach has garnered support from major creditors, signaling a potential shift towards addressing governance issues at the root of economic crises. The proposal also introduces a new security that links bond repayments to the country’s economic performance, setting a precedent for future debt instruments in emerging markets.

Implications and Challenges for Investors

While the governance-linked bond offers a promising solution to addressing governance issues, some investors raise concerns about the measurement and verification of government progress. Clarity and specific metrics will be crucial for ensuring the success of this initiative and maximizing its potential benefits. Despite these challenges, the bond deal represents a significant opportunity for Wall Street to promote good governance and reduce the risk of future defaults in emerging markets like Sri Lanka.

As Wall Street’s focus shifts towards incentivizing government accountability, the governance-linked bond deal in Sri Lanka sets a new standard for debt restructuring and economic development initiatives globally. By aligning financial incentives with governance improvements, this innovative approach has the potential to reshape the landscape of international finance and drive positive change in countries facing economic challenges due to poor governance.