We do not yet know to what extent wealth management will be disrupted by the use of artificial intelligence. From optimizing returns to changing the role of advisors, this entire sector of activity is on the verge of an unprecedented transformation.

“The industry will be shaken up more by artificial intelligence than it has been in the last 60 years,” warns Carl Thibeault, senior vice-president for Quebec and the Atlantic provinces at IG Gestion de heritage.

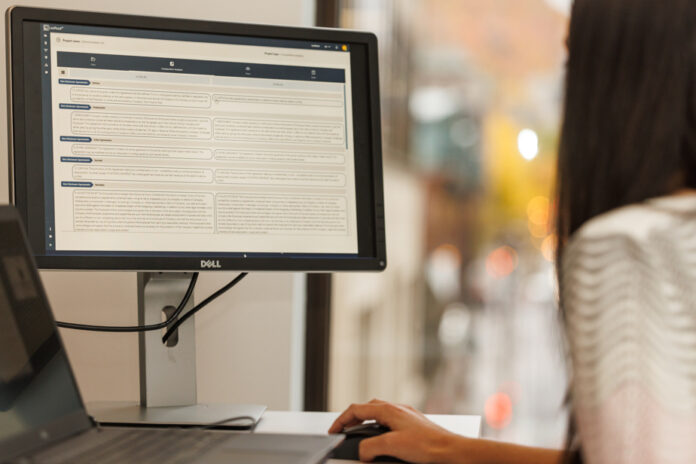

Artificial intelligence (AI) is already used at IG Wealth Management. “We use elements of artificial intelligence to improve the execution of plans, and ensure that the projections are as close as possible to reality,” explains Carl Thibeault. This results above all in a shorter writing time than in the past. »

But this is only the beginning of an immense transformation, because the applications will constantly expand. “Artificial intelligence [AI] will become a major tool in wealth management,” assures the man who is also a member of the steering committee of the IG Wealth Management Chair in Financial Planning at Laval University. “We will be able to provide greater precision and speed, and we will be able to go even further in complexity. »

For example, the selection of investment vehicles takes a lot of time. By entrusting this task to AI, “time will be freed up for tax and estate planning, which is a very complex issue in wealth management,” illustrates Carl Thibeault.

AI does not yet allow financial robots to cover all aspects of wealth management. “Today, we are in the early stages,” observes Michel Mailloux, president of the College of Financial Professions and author of the book Financial Robots and AI.

These financial robots, or financial dialoguers, as Michel Mailloux calls them, will be able to establish all the necessary links to cover all aspects of wealth management. They will consider all of the clients’ financial and insurance issues. “All financial planners dream of offering this, but it is impossible to know everything in every area,” summarizes Michel Mailloux.

We know that an advisor provides on average an annual return of 1.8% higher than that which an independent investor would obtain, indicates Mr. Mailloux, but “financial dialoguers will improve this return by 25 to 40 basis points”, he believes.

AI could also give access to wealth management to a larger part of the population. Technological tools can be made available to less fortunate clients, whereas it would be too expensive today to dedicate a team of experts to basic needs.

How will the customer know the calculations made by the AI? It’s very simple… it will be impossible to be transparent, says Michel Mailloux. “The algorithms themselves can go to other algorithms depending on what they find, which makes it inconceivable to follow their reasoning. »

The role of the advisor will therefore be to exercise judgment, interpreting the recommendations made by the AI. “Rather than the transparency of calculations, the massive use of artificial intelligence requires the explanation of the solution,” affirms Michel Mailloux. This fundamentally changes the nature of wealth management advice. »