Is the life annuity ripe for harvest?

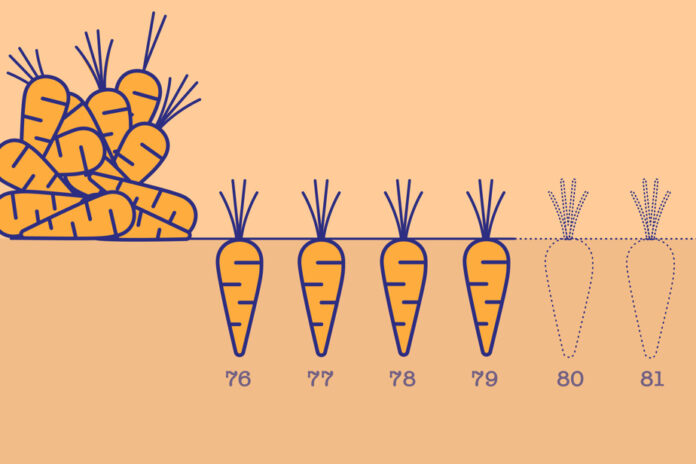

On January 16, 2021, a lump sum payment of $100,000 purchased a lifetime annuity of $461 per month for a 65-year-old man (the juicy details are in the next tab).

If it was taken out at the beginning of October 2023, the same amount would instead provide a monthly pension of $615.

A difference of $154 each month for our man. That’s 33% more.

The reason ?

Particularly because interest rates are higher in 2023.

According to information provided by Desjardins Financial Security, the Advisory Services and Advanced Solutions unit of the Cloutier Group, to take this example, has received three life annuity quote requests per day for the past year. Between 2021 and 2022, she received one per month.

Could it be time to buy a life annuity, that unloved and misunderstood one?

First, let’s clarify the concept.

Life annuity. That is to say paid for life. The word comes from the old French “viage”, duration of life.

By transferring a certain amount of capital to a life insurer, you buy a regular and guaranteed income until the end of your days, however late it may be.

This annuity is calculated according to your life expectancy, therefore your age and your gender (gender at birth, we assume), and on the return that the life insurer hopes to achieve by investing the capital that you transfer to it.

“He doesn’t invest that in the stock market, he invests it in the bond market, where interest rates matter a lot. If the insurer is able to invest the money I give them at a higher rate, I will get a higher retirement income for my capital, all other things being equal,” explains financial planner and actuary Dany Provost , director of financial planning and tax optimization at SLF Gestion de Patrimoine.

Purchasing a life annuity therefore becomes more attractive when interest rates are hypertrophied and are likely to remain so for a certain time, as is the case at present.

“That’s the official speech. I have a different perception of life annuity,” says the planner.

“It is not my position to follow the evolution of rates in the market to decide whether to buy a life annuity or not. I see it as insurance. But instead of being premature death insurance, like life insurance, it is late death insurance. The risk of dying at an advanced age is what I want to protect with the purchase of a life annuity. »

A point of view shared by financial planner Kevin Lee, lecturer at Laval University, where he teaches the course Financial Products: Insurance and Annuities in the Financial Planning concentration of the Bachelor of Business Administration.

“People see it as an investment, when it’s a protection tool,” he says.

The parent who has significant family responsibilities does not wait for interest rates to be favorable to take out life insurance, he gives as an example.

“For the life annuity, it’s the same thing. Do you need it, do you have the profile to buy an annuity? »

But because rates haven’t been this favorable in a long time, it’s certainly an opportune time to ask these questions.

“The important thing is that people can think about this possibility,” says financial planner and actuary Nathalie Bachand, of the Bachand Lafleur consulting group.

Okay, let’s think about it.