Investing in Semiconductor ETFs for Higher Returns

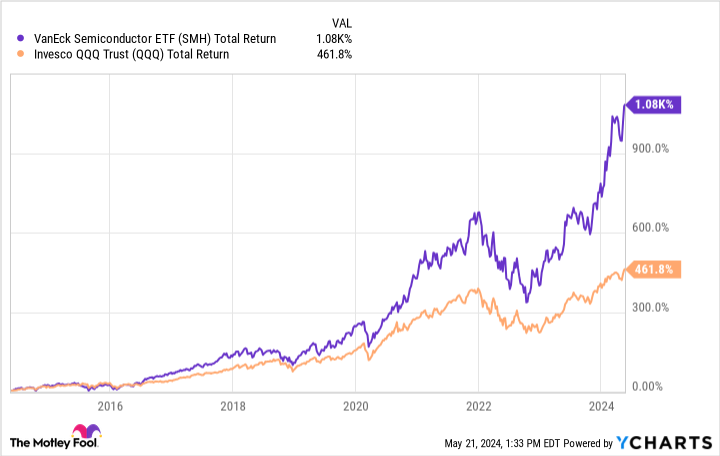

Investing in the stock market can be a daunting task, especially with the abundance of options available. One popular choice for many investors has been the Nasdaq 100 and its corresponding ETF, the Invesco QQQ Trust. However, there is a new player in town that has been outperforming the Nasdaq 100 – the VanEck Semiconductor ETF (NASDAQ: SMH).

Why Choose Semiconductor ETFs Over Nasdaq 100?

Semiconductors have been a standout performer in the tech industry, driving tech returns higher than ever before. The VanEck Semiconductor ETF holds only 26 stocks, compared to the Nasdaq 100’s 100 stocks, making it a more focused investment on a specific part of the tech industry. While the VanEck ETF comes with a higher level of risk, it has shown impressive returns over the last year, outperforming the Invesco QQQ Trust.

Stock Investments in VanEck Semiconductor ETF

The VanEck Semiconductor ETF has made significant investments in key semiconductor stocks such as Nvidia, Taiwan Semiconductor, and Broadcom. These stocks have been driving the fund’s returns with their dominance in the chip industry and strong demand for AI chips and networking products. With a diversified portfolio of stocks in various subsegments of the semiconductor industry, the VanEck ETF offers investors a balanced exposure to this high-growth sector.

Investing in the VanEck Semiconductor ETF can be a strategic move for investors looking to capitalize on the growing demand for semiconductors and AI technologies. While the fund comes with its risks, the potential for high returns and long-term growth in the semiconductor industry makes it a compelling option for investors seeking to diversify their portfolios and maximize their investment potential.