The landscape of the UK housing market is undergoing significant changes as mortgage rates continue to rise. This trend has captured the attention of potential homebuyers, homeowners, and financial experts alike. Understanding the implications of these changes is crucial for anyone involved in the property market.

The Current State of UK Mortgage Rates

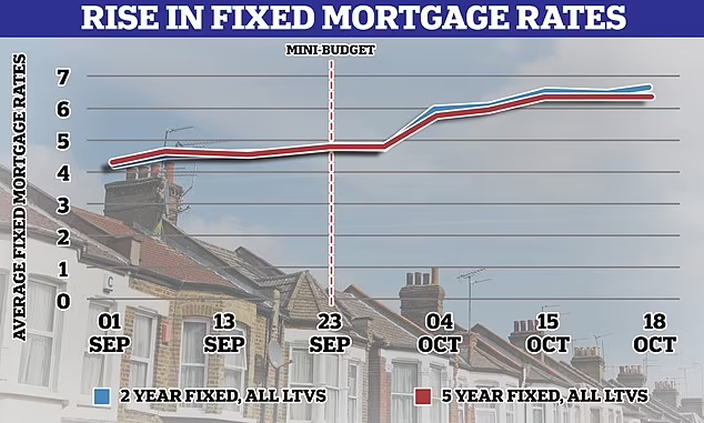

Mortgage rates in the UK have been on an upward trajectory, influenced by a combination of factors including economic policies, inflation, and global financial trends. This rise is making mortgages more expensive for borrowers, affecting affordability and potentially slowing down the housing market.

Reasons Behind the Rising Mortgage Rates

Several key factors are driving the increase in mortgage rates:

- Economic Policies: The Bank of England has been adjusting interest rates to combat inflation, leading to higher borrowing costs.

- Inflation: As inflation rates climb, lenders increase mortgage rates to maintain their profit margins.

- Global Economic Trends: International economic instability can influence domestic mortgage rates, as seen with the recent fluctuations in global markets.

Impact on Homebuyers and Homeowners

The rising mortgage rates are having a profound impact on both prospective and current homeowners:

- Affordability Challenges: Higher rates mean larger monthly payments, making it harder for first-time buyers to enter the market.

- Refinancing Difficulties: Existing homeowners looking to refinance their mortgages are facing higher costs, reducing their potential savings.

- Market Slowdown: As borrowing becomes more expensive, the demand for homes may decrease, leading to a potential slowdown in the housing market.

Strategies for Homebuyers and Homeowners

To navigate the rising mortgage rates, both homebuyers and homeowners can adopt several strategies:

- Locking in Rates: Securing a fixed-rate mortgage can protect borrowers from future rate increases.

- Shopping Around: Comparing offers from different lenders can help find the most competitive rates.

- Improving Credit Scores: A higher credit score can qualify borrowers for lower interest rates.

- Considering Alternative Financing: Exploring options like adjustable-rate mortgages (ARMs) can be beneficial in certain scenarios.

The Role of Government and Financial Institutions

Government policies and actions by financial institutions play a crucial role in shaping the mortgage market:

- Policy Interventions: Government programs aimed at supporting first-time buyers can alleviate some of the financial burdens.

- Lender Flexibility: Banks and mortgage lenders offering more flexible terms and conditions can help mitigate the impact of rising rates.

SEO-Optimized Answers to Key Questions:

How do rising mortgage rates affect home affordability? Rising mortgage rates increase the cost of borrowing, leading to higher monthly payments. This reduces the affordability of homes for buyers, especially those entering the market for the first time.

What are the primary causes of increasing mortgage rates in the UK? The primary causes include economic policies aimed at controlling inflation, global economic trends, and the financial strategies of lenders to maintain profitability.

How can homebuyers protect themselves against rising mortgage rates? Homebuyers can protect themselves by securing fixed-rate mortgages, improving their credit scores, and shopping around for the best rates available from different lenders.

What is the impact of high mortgage rates on the housing market? High mortgage rates can lead to a slowdown in the housing market as fewer people can afford to buy homes. This can reduce demand, potentially leading to lower house prices over time.

Are there any government programs to help first-time buyers in a high mortgage rate environment? Yes, government programs like Help to Buy and shared ownership schemes are designed to assist first-time buyers by making homes more affordable despite rising mortgage rates.

What strategies can existing homeowners use to manage higher mortgage payments? Existing homeowners can refinance their mortgages to secure better rates, adjust their budgets to accommodate higher payments, and consider loan modification programs offered by lenders.

How do global economic trends influence UK mortgage rates? Global economic trends, such as changes in international interest rates and economic stability, can impact UK mortgage rates by influencing the financial markets and lending practices.

What role does the Bank of England play in mortgage rate changes? The Bank of England sets the base interest rate, which directly affects mortgage rates. By increasing or decreasing this rate, the Bank of England can influence the cost of borrowing across the country.

Can improving credit scores help in securing lower mortgage rates? Yes, a higher credit score can help borrowers secure lower mortgage rates, as lenders view them as less risky and more likely to make timely payments.

What are the benefits of fixed-rate mortgages in a rising rate environment? Fixed-rate mortgages offer stability and predictability in monthly payments, protecting borrowers from future increases in mortgage rates and making long-term financial planning easier.